how to buy tax liens in maricopa county

The county holds onto. The sale vests in the purchaser all right title and interest of Kern County in the property including all delinquent taxes which have become a lien since issuance of California tax deed.

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

A number will be assigned to each bidder for use when.

. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Maricopa County AZ currently has 14 tax liens available as of June 15. Tax Deeded Land Sales.

Arizona Tax Auction Update. Can you buy tax liens in Arizona. In North Carolina when you buy and you win you do not get possession.

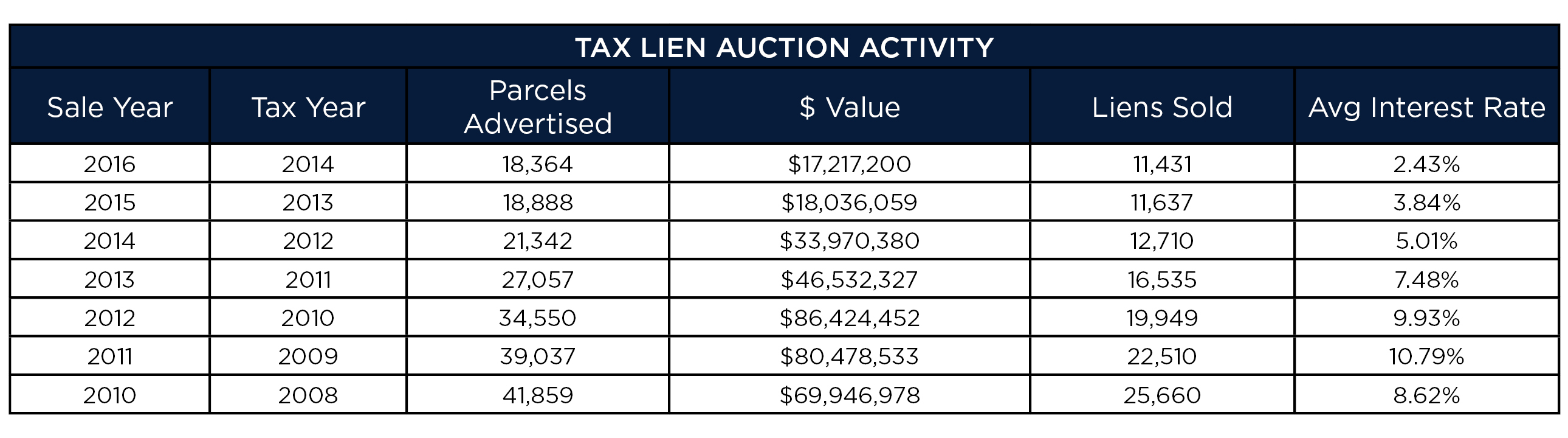

Maricopa County AZ currently has 18422 tax liens available as of October 26. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. In fact the rate of return on property tax liens investments in Maricopa County AZ can be anywhere between 15 and 25 interest.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. Maricopa County County AZ tax liens available in AZ. Tax deeded land sales are conducted by the Maricopa County Treasurers Office on an as-needed basis with Maricopa County acting as the agent for the.

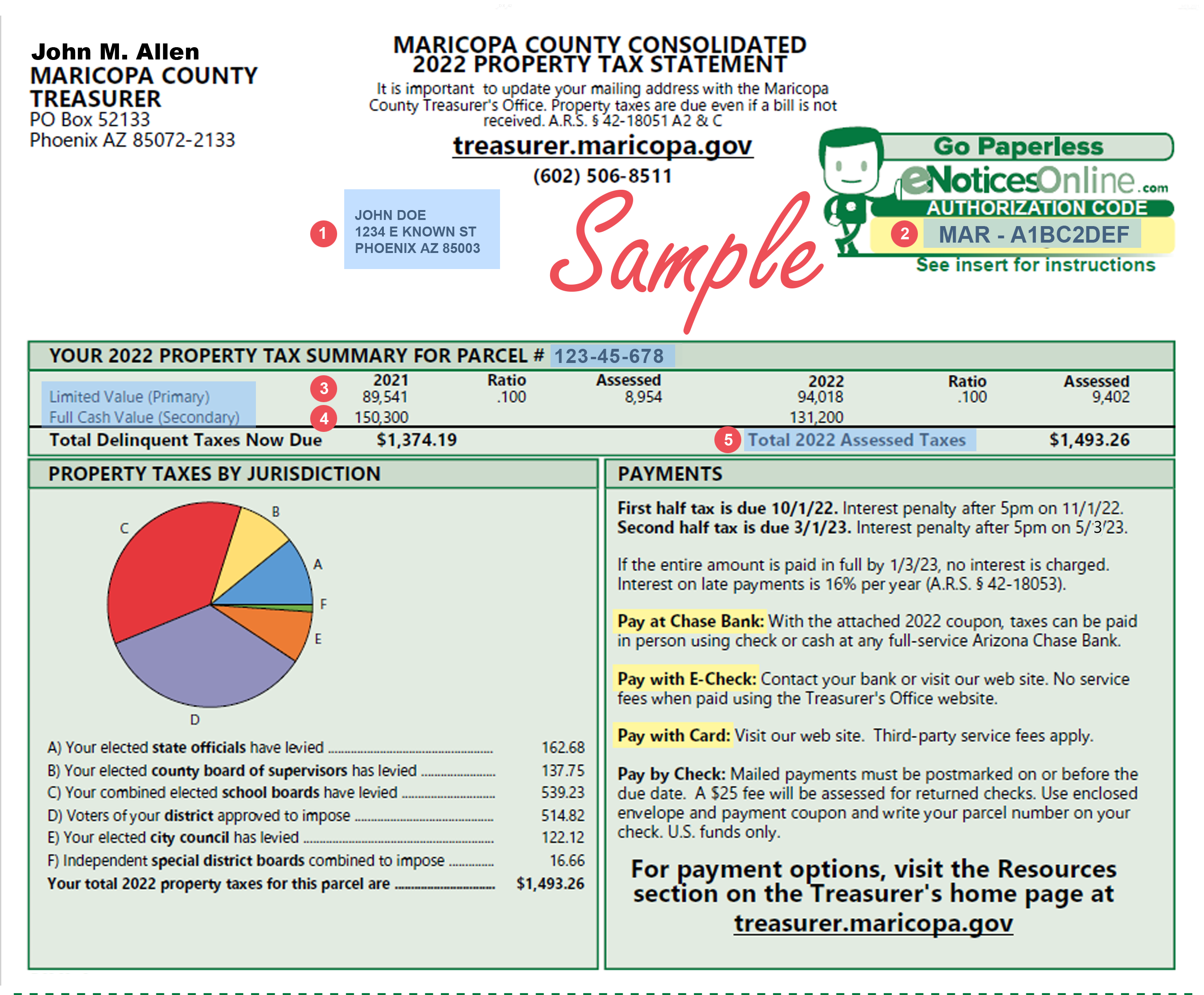

You can now map search browse tax. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Upon receipt of a cashiers check or certified funds the Department of Revenue will immediately provide a Notice of Intent to Release State Tax.

Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. Learn to buy tax liens in Maricopa County AZ today. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including.

4 counties in Arizona have now released their property lists in preparation for the 2022 online tax lien sales. Payment in full with Cash or Certified Funds. Generally speaking when you buy a tax defaulted property at an auction you get possession.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest. In Maricopa county if a property owner does not pay property taxes the local county will issue a tax lien certificate.

Maricopa County Assessor S Office

How Tax Lien Investing Works And How To Buy Tax Lien Certificates

The Essential List Of Tax Lien Certificate States

Maricopa County Island What Is It Arizona Homes Horse Property

Maricopa Az Land For Sale Real Estate Realtor Com

Wall Street Quietly Creates A New Way To Profit From Homeowner Distress Center For Public Integrity

Gis Mapping Applications Maricopa County Az

Property Taxes In Arizona Lexology

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

How To Buy Real Estate Tax Liens And Earn Up To 36

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

A Conversation With Charles Hos Hoskins Former Maricopa County Treasurer

Gis Mapping Applications Maricopa County Az

How To Buy Tax Liens In Maricopa County Youtube

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Is Arizona A Tax Lien Or Tax Deed State The Answer May Surprise You